Hey Dear Students, in this Page you will Get a Complete Solution of B.COM 4th Semester (Hons/Regular) Cost Accounting

Cost Accounting

Unit 2 : Elements of Cost : Material

SHORT ANSWER TYPE QUESTIONS

Q. What is Inventory?

Ans: Inventory is the term for the goods available for sale and raw materials used to produce goods available for sale. Inventory represents one of the most important assets of a business because the turnover of inventory represents one of the primary sources of revenue generation for the owner of the business. Thus, the term inventory or stock comprises:

(i) Raw material, (ii) Work-in-Progress, and (iii) Finished Products.

Q. What is Inventory control?

Ans: Inventory control may be defined as "systematic control and regulation of purchases, storage and uses of material in such a way so as to maintain an even flow of production and at the same time avoiding excessive investment in inventories.

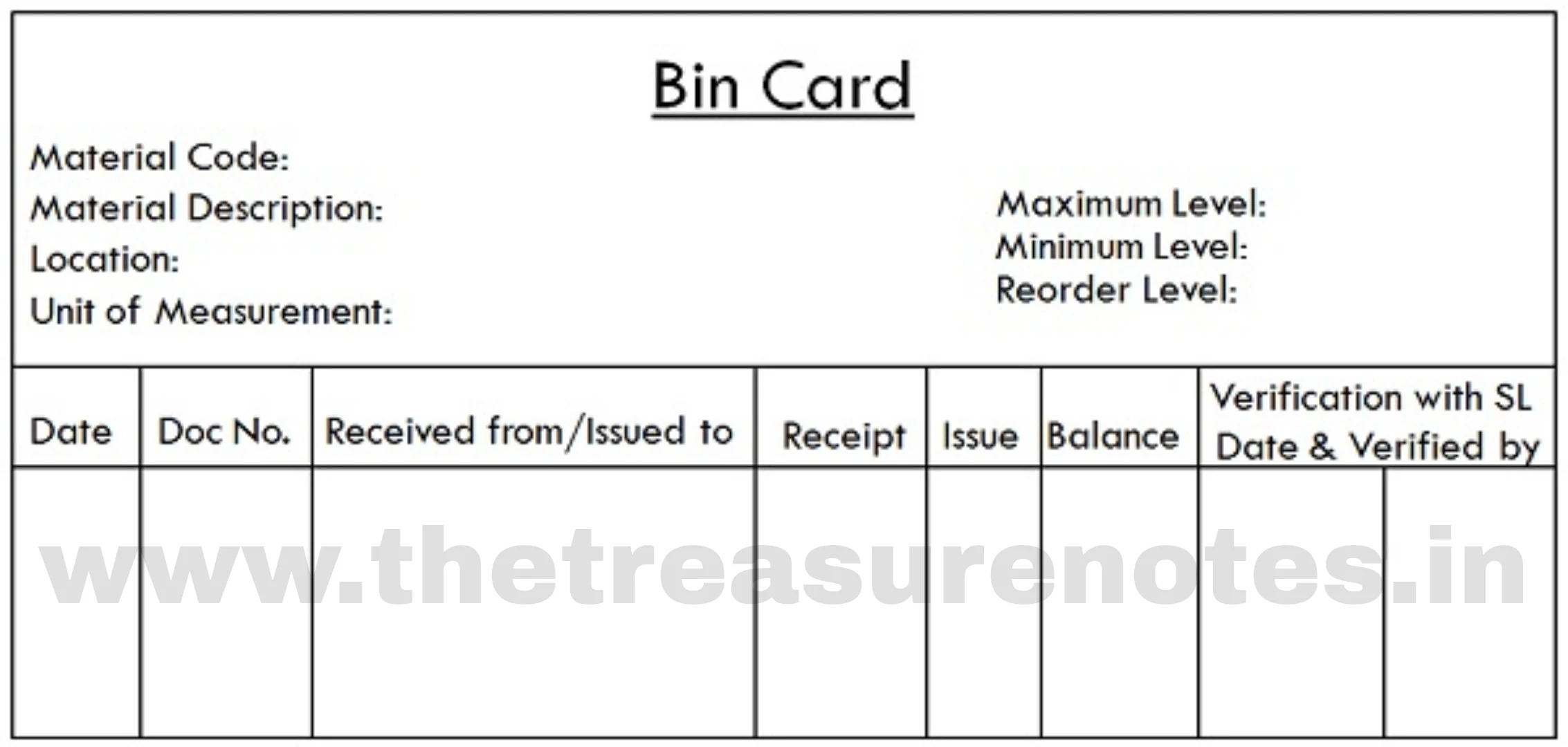

Q. What is Bin Card?

Ans: In cost accounting, bin card is used to mean a document that keeps a record of the items held in stores. Bin Implies a container or space to keep materials, and with each bin, a card is placed, that comprises of details of material received, issued and returned. Moreover, it contains relating to the number of items, their description and relevant notes, if any.

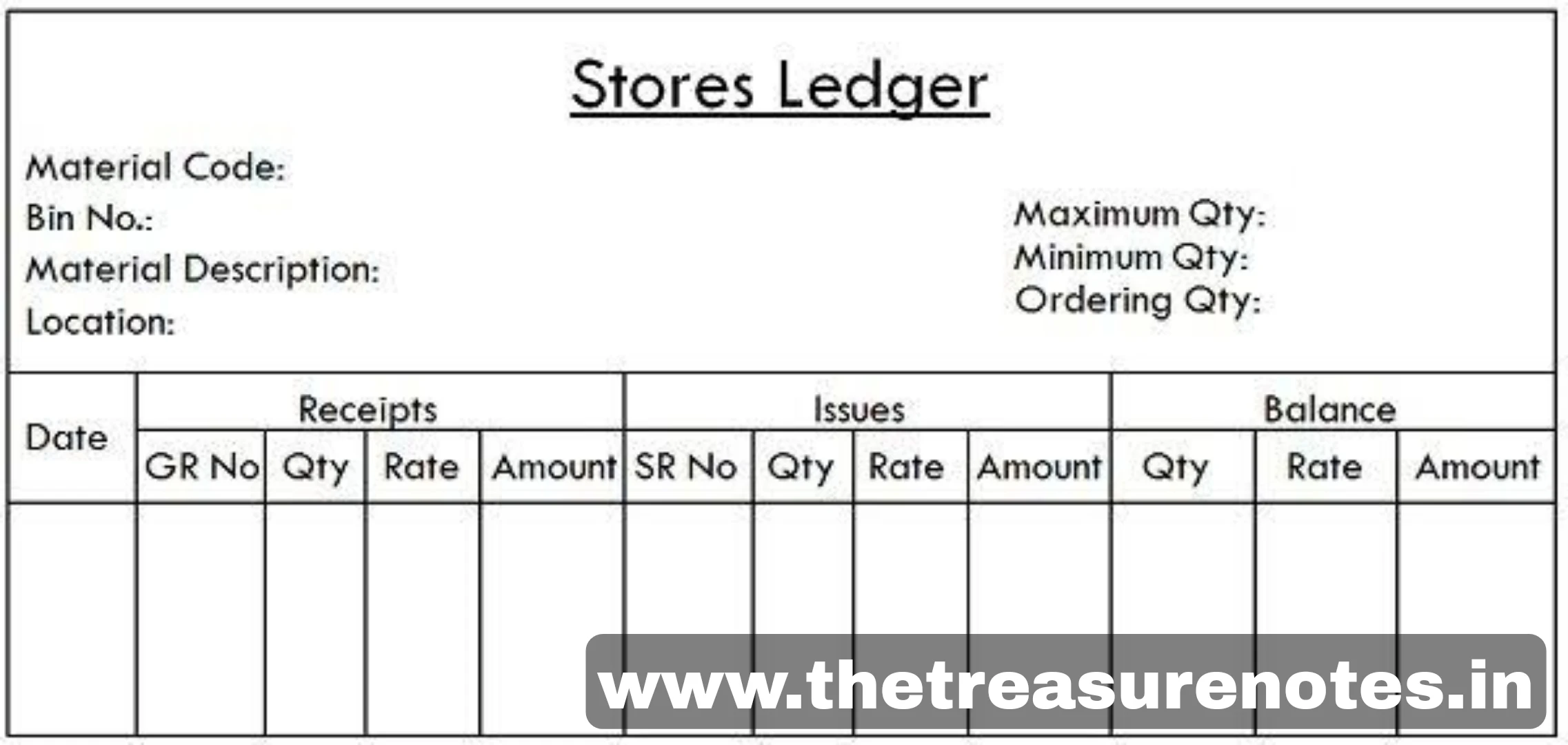

Q. What is Stores Ledger?

Ans: Stores Ledger is used to record both quantity and amount of receipts and issues. It is a document or statement that keeps the records of the value and quantity of different stock items issued, received and their closing balance. It is often compared with Bin cards as both of these statements are used to record stock materials.

Q. Draw the specimen of Bin Card.

Ans :

Q. Draw a specimen of Store Ledger.

Ans:

Q.What is Re-Ordering Level?

Ans: When the quantity of materials reaches a certain level than fresh order is sent to procure materials again. The order is sent before the materials reach minimum stock level. Re-ordering level is fixed between minimum level and maximum level. Re-ordering level is fixed with following formula:

Re-ordering Level = Maximum Consumption x Maximum Re ordering period

Q.What is minimum Level?

Ans: This represents the quantity which must be maintained in hand at all times. If stocks are less than the minimum level, then work will stop due to shortage of materials. baland St Minimum Stock Level = Re-Ordering Level (Normal consumption x Normal Reorder Period)

Q.What is maximum Level?

Ans: It is quantity of material beyond which a firm should not exceed its stocks. If the quantity exceeds maximum limit then it will be termed as overstocking. A firm avoids overstocking because it will result in high material costs. Overstocking will lead to the requirement of more capital, more space for storing the materials and more chances of losses from obsolescence.

Maximum stock level = (Reordering level + Reordering quantity) -(minimum consumption x minimum reordering period)

Q.What is Average Stock Level?

Ans: Average Stock Level = Minimum Stock Level +1/2 of Reorder quantity

"Gauhati University Cost Accounting Notes B.COM 4th Semester"

LONG ANSWERS TYPE QUESTIONS

Q. Explain the FIFO method of valuation of materials issue along with its advantages and disadvantages.

Ans: It is a method of pricing the issue of materials in the order in which they are purchased. In other words, the materials are issued in the order in which they arrive in the store. This method is considered suitable in times of falling prices because the material cost charged to production will be high while the replacement cost of materials will be low. In case of rising prices this method is not suitable.

Advantages of FIFO :

(i) It is simple and easy to operate

(ii) In case of falling prices, this method gives better results.

(iii) Closing stock represents the market prices.

Disadvantages of FIFO :

(i) If the prices fluctuate frequently this method may lead to clerical errors.

(ii) In case of rising prices this method is not advisable.

(iii) The material costs charged to same job are likely to show different rates.

Q. Explain the LIFO method of valuation of materials issue along with its advantages and disadvantages.

Ans: Under this method the prices of last received batch(lot) are used for pricing the issues, untill it is exhausted and so on. During the inflationary period or period of rising prices, the use of LIFO would help to ensure the cost of production determined approximately on the above basis is approximately the current one. Under LIFO stocks would be valued at old prices, but not represent the current prices.

Advantages of LIFO :

(i) The cost of materials issued will be either nearer to or will reflect the current market price.

(ii) In case of falling prices profit tends to rise due to lower material cost.

Disadvantages of LIFO :

(i) The computations become complicated if too many receipts are there.

(ii) Companies having JIT system will face this problem more.

*****

We hope the G.U Cost Accounting Notes for B.Com 4th sem provided on this page helps in your Semester exam preparation. If you have any questions, ping us through the comment section below and we will get back to you as soon as possible