Hello friends welcome to our site The Treasure Notes

Are you looking for Income Tax law and Practice Question paper 2021 for 3rd semester Gauhati University(CBCS) is Now Helpful for FYUGP NEP 4th Semester Students? If you want to know about Gauhati University FYUGP NEP 4th B.COM Semester Income Tax law and Practice Question Paper 2021 Pdf, then in today's post we have discussed what was asked in Gauhati University B.COM Third Semester Income Tax law and Practice Question paper 2021(Held in 2022) Very Helpful for FYUGP NEP 4th Semester Exam.

So, you read this post from beginning to end, after that you will get to know about Gauhati B.com 3rd Sem Income Tax law and Practice Question paper 2021(CBCS Pattern) is Now FYUGP NEP Accountancy Major Income Tax and Laws Questions Paper.

Gauhati University B.Com 3rd Sem CBCS Pattern - The Treasure Notes

2021 (Held in 2022)

COMMERCE (Honours/Regular)

Paper:COM-HC-3026/COM-RC-3026

(Income Tax Law and Practice)

Full Marks: 60

Time: Three hours

The figures in the margin indicate full marks for the questions.

1. Answer the following as directed: 1×7=7

(a) ‘Assessment Year’ means the period starting from 1st April ending on _______ of the next year. (Fill in the blank)

(b) The year in which income is earned is known as Assessment Year and the year in which it is taxable is known as Previous Year. (State whether the statement is true or false)

(c) Under the Income Tax Act, 1961, what is the status of Dibrugarh University as a ‘Person’?

(d) Tax liability of an assessee depends upon his/her residential status. (State whether the statement is true or false)

(e) Agricultural income is taxable under section 10(1) of the Income Tax Act, 1961. (State whether the statement is true or false)

(f) Section 48 of the Income Tax Act deals with income that is exempted from tax. (State whether the statement is true or false)

(g) Agricultural land situated in a rural area in India is a Capital Asset. (State whether the statement is true or false)

2. Answer the following questions: 2×4=8

(a) Explain the meaning of long-term capital gain.

(b) State the meaning of uniform previous year as per the Income Tax Act, 1961.

(c) Define ‘Assessee’ as per the Income Tax Act, 1961.

(d) State the meaning of income.

3. Answer any three questions: 5×3=15

(a) Briefly explain various heads of income.

(b) Explain the manner of determining the residential status under ‘resident and ordinarily resident’ in India.

(c) Explain the meaning of ‘income from other sources’ as per the Income Tax Act, 1961 with any three examples.

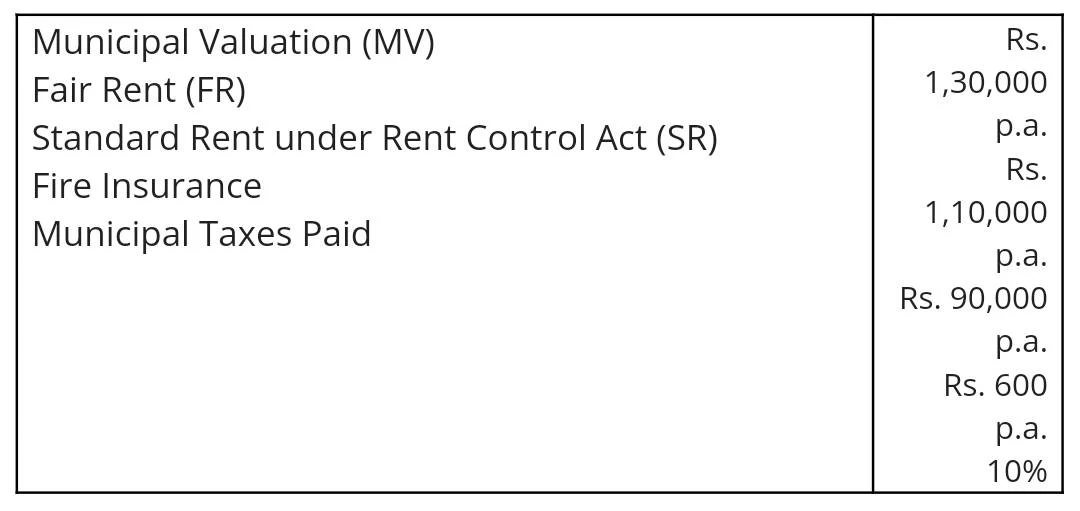

(d) Mr. Anil Barua is the owner of a house property which is let out by him at a monthly rent of Rs. 10,000. The particulars of the house are given below:

Determine his income from house property for the assessment year 2021-22. 5

(e) For the Assessment Year 2021-22, Ramesh is non-resident in India. From the information given below, find out his income chargeable to tax for the Assessment Year 2021-22:

(1) Royalty received by him outside India from the Government of India Rs. 17,000.

(2) Technical fees received from P. Ltd. (an Indian Company) in Germany for advice given by him in respect of a project situated in Dubai Rs. 2,40,000.

(3) Income from a business situated in Sri Lanka (goods are sold in Sri Lanka, sale consideration is received in Sri Lanka but business is controlled partly in Sri Lanka and partly in India) Rs. 1,40,000.

(4) Income from a business connection in India (it is received outside India) Rs. 3,17,000.

4. Answer any three questions: 10×3=30

(a) What is a capital asset as per section 2(14) of the Income Tax Act, 1961? Describe the procedure of computation of long term capital gains as per the provisions of this Act. 5+5=10

(b) Sitaram (age 45, resident) is a salaried employee (salary being Rs. 40,000 per month). During the previous year 2020-21, he makes the following investment deposits or payments:

(1) Life insurance premium (policy taken in 2009) on the life of his married daughter: Rs. 6,000 (sum assured is Rs. 20,000.

(2) Life insurance premium (policy taken in 2011) on his own life: Rs. 2,700 (sum assured Rs. 60,000).

(3) Life insurance premium (policy taken in 2011) on his life of his dependent sister: Rs. 10,000.

(4) Contribution towards recognised Provident Fund: Rs. 9,000.

(5) Contribution towards public Provident Fund: Rs. 1,30,000.

(6) Repayment of loan taken from LIC for purchase of residential house property: Rs. 30,000.

(7) Contribution towards notified equity-linked saving scheme of UTI (i.e., MEP 2021): Rs. 14,000.

Compute his Tax Liability for the Assessment Year 2021-22, assuming that his income from house property is Rs. 2,28,900. 10

(c) From the following Profit & Loss A/c of Sudesh Bhosale (Age 45 years; resident) for the year ended on 31st March, 2021, ascertain his Gross Total Income for the AY 2021-22: 10

Other Information:

(1) The amount of depreciation allowable is Rs. 57,000 as per Income Tax Rules.

(2) Advertisement expenditure includes Rs. 3,000 being the cost of permanent sign board fixed on the office premises.

(3) Income of Rs. 3,08,700, accrued during the previous year, is not recorded in the Profit and Loss A/c.

(4) Sudesh Bhosale pays Rs. 15,000 as premium on own life insurance policy of Rs. 70,000.

(5) General expenses include Rs. 12,000 given to Mrs. Sudesh Bhosale for purchasing a gift for a marriage party of a friend’s daughter.

(6) Loan was taken from Mrs. Sudesh Bhosale for payment of arrears of income tax.

(d) Briefly explain the basic rules governing the deductions under section 80C to 80U of the Income Tax Act, 1961.

(e) Explain the process of setting off of losses and their carry forward as per the provisions of the Income Tax Act, 1961. 10

(f) Write short notes on the following: 5+5=10

(1) On-line filing of returns of income.

(2) Tax deducted at source.

-0000-

.webp)