Welcome to our Website

The Treasure Notes

If you are a student of Assam University: Silchar B.Com 2nd (odd) sem and looking for Assam University: Silchar Corporate Accounting Question Paper 2019 Bcom 2nd Sem CBCS then you are in right place here in this page we have Shared Assam University Corporate Accounting Question Paper 2019 Which can be very beneficial for your upcoming examinations.

Reading previous year question papers have great advantage not only in semester exam but for any examinations student must familiar with the question asked in previous year and prepare accordingly. In this page Assam University Silchar B.com 2nd Sem Corporate Accounting Question Paper 2019 can help you in Better Analysis of Questions and Question Paper Patterns.

If you want to read in detail Assam University Silchar Corporate Accounting Question Paper 2019 Bcom 2nd Semester as per CBCS Pettern read this Post from top to bottom and try to solve this question paper if you have any problem regarding to the solution of question paper you can also follow our solution.

Solution link: Assam University Corporate Accounting Solved Paper 2019

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

Assam University B.Com 2nd Sem Question Papers, CBCS Pattern

Corporate Accounting', Assam University B.Com 2nd Sem 2019 Question Papers

TDC (CBCS) Even Semester Exam., 2019

COMMERCE (2nd Semester)

Course No.: BCH – CC – 201T

(Corporate Accounting)

Full Marks: 70

Pass Marks: 28

Time: 3 hours

The figures in the margin indicate full marks for the questions

UNIT – I

1. Answer any two questions from the following: 2x2=4

a) Explain the concept of ‘book building’.

b) Write two advantages of buyback of shares.

c) State two conditions of redemption of preference shares.

2. What is ‘sinking fund’? Explain the procedure of redemption of debentures by sinking fund method with accounting entries. 2+8=10

Or

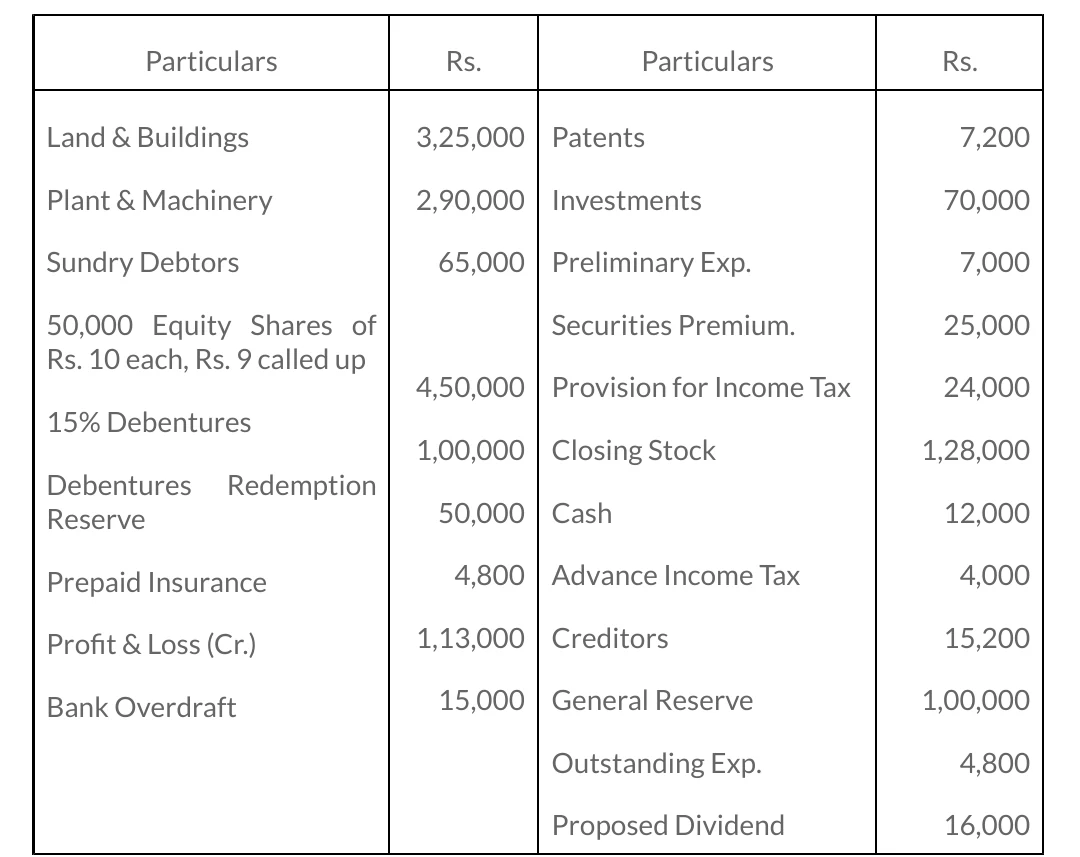

From the following Balance Sheet of Estar Ltd. as on 31.03.2018, you are required to give effect to the proposal of bonus shares by passing Journal entries. You are also required to show the amended Balance Sheet as on that date:

Balance Sheet

As on 31.03.2018 of Estar Ltd.

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

UNIT – II

3. Answer any two questions from the following: 2x2=4

a) Differentiate between Capital Reserve and Reserve Capital.

b) Explain the meaning of contingent liability with examples.

c) What are the purposes served by Schedule VI of the Companies Act, 2013?

4. From the following balances extracted from the books of Swift Ltd. as on 31.03.2018 and additional information, prepare profit & loss A/c of the company: 10

Additional Information:

1) Value of inventory on 31.03.2018 – Rs. 87,500.

2) Staff Salaries Outstanding – Rs. 6,500.

3) Insurance Premium prepaid – Rs. 1,200.

4) Depreciation to be charged on Machinery @ 10%.

5) Provision for bad debt @ 5% on debtors.

6) Transfer Rs. 10,000 to General Reserve.

7) Directors proposed, a dividend of 5% on the paid –up equity share capital.

Or

From the following balances taken from the books of Escorts Ltd., prepare the Balance Sheet as at 31.03.2018:

Further Information:

1) Bills discounted but not yet matured Rs. 12,000.

2) There is a claim against the company not acknowledged ad debt Rs. 16,000.

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

UNIT – III

5. Answer any two questions from the following: 2x2=4

a) Explain why goodwill is considered as an asset.

b) Mention four methods of valuation of goodwill.

c) State the circumstances in which there may be need for valuation of shares in case of companies.

6. The following particulars have been extracted from the books of Sachin:

1) Capital Invested – Rs. 50,000

2) Trading Results:

Rs.

2015 Profit 18,200

2016 Profit 15,000

2017 Loss 2,000

2018 Profit 21,000

3) Market rate of interest on investment – 8%.

4) Rate of return on capital in business – 2%.

5) Remuneration from alternative employment of the proprietor (if not engaged in business) – Rs. 6,600 p.a.

Compute the value of goodwill of the business on the basis of three year’s purchase of super profits taking average of last four years. 10

Or

From the following information, calculate the value of per equity share: 10

20000, 9% Preference Shares of Rs. 100 each – Rs. 2,00,000

50000 Equity Shares of Rs. 10 each Rs. 8 paid up – Rs. 4,00,000

Expected profits before tax – Rs. 2,18,000

Rate of tax – 50%

Transfer to General Reserve every year – 20% of profit

Normal rate of earning – 15%.

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

UNIT – IV

7. Answer any two questions from the following: 2x2=4

a) Write the situations under which an enterprise can become a holding company.

b) Define the term ‘minority interest’.

c) Explain the objectives of preparation of Consolidated Financial Statements.

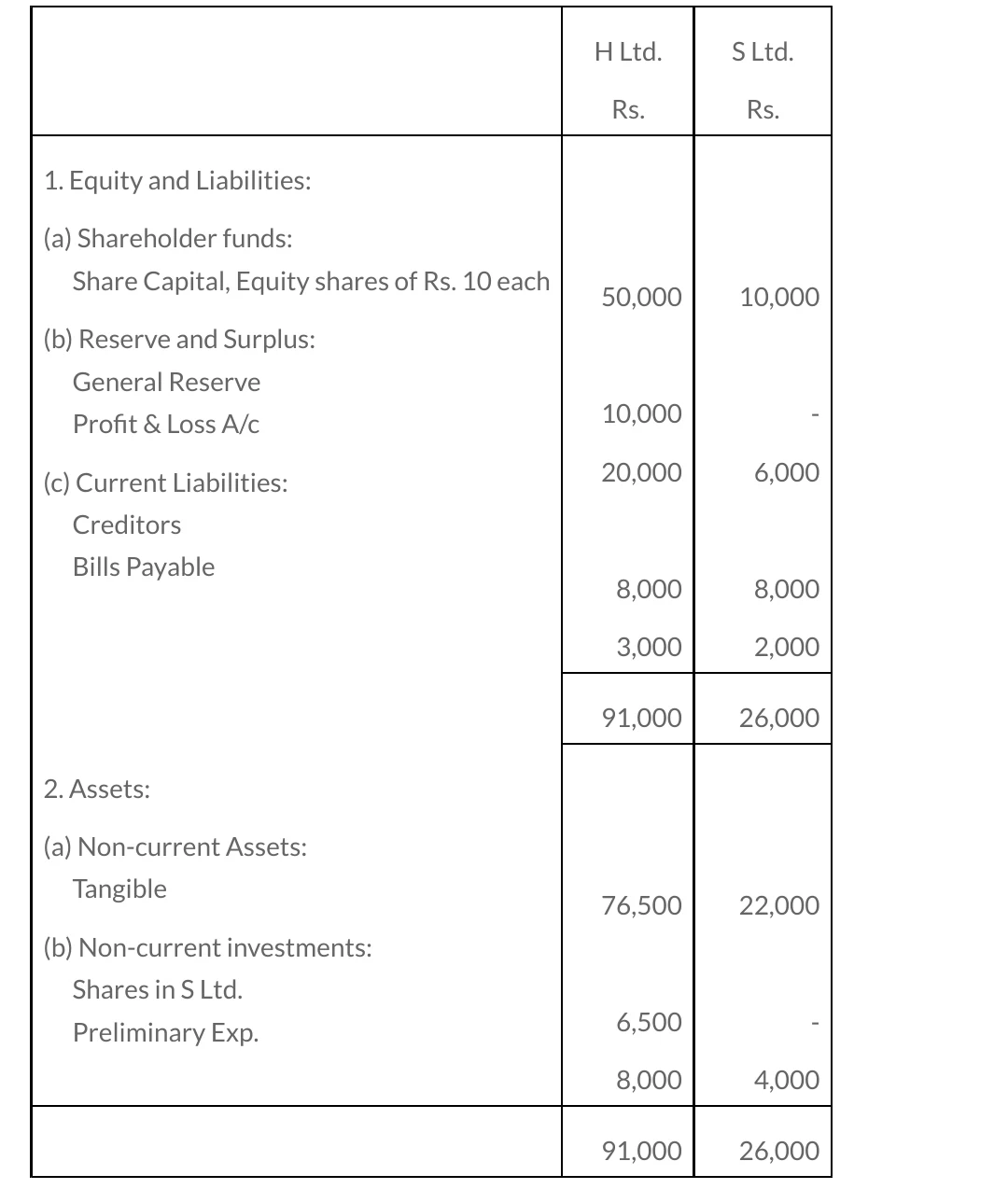

8. The Balance Sheet of H Ltd. and its subsidiary S Ltd. as on 31.03.2018 stood as follows:

H Ltd. acquired 60% interest in S Ltd. All the profits of S Ltd. was earned after the shares were acquired by H Ltd. Prepare the Consolidated Balance Sheet of H Ltd. and its subsidiary S Ltd. on 31.03.2018: 10

Or

Describe the provisions of Accounting Standard – 21 in relation to the preparation of Consolidated Financial Statements. 10

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

UNIT – V

9. Answer any two questions from the following: 2x2=4

a) State the main features of bank’s accounting system.

b) Explain two provisions of the Banking Regulation Act, 1949 relating to the annual accounts of a banking company.

c) Explain the meaning of the terms ‘Reinsurance’ and ‘Surrender Value’

10. From the following information, prepare Profit & Loss A/c of Money Plus Bank for the year ended 31.03.2018:

Additional Information:

a) Provide for contingencies – Rs. 2,00,000.

b) Transfer Rs. 15,57,000 to Reserves.

c) Transfer Rs. 2,00,000 to Central Government.

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

Or

How is profit or loss ascertained in life insurance business? Prepare with imaginary figures Revenue A/c of a Life Insurance Company. 10

Assam University Silchar TDC 2nd Sem Corporate Accounting Question Paper 2019

***

Also Read :-

Assam University B.Com 2nd Sem Question Papers

👉CorporateAccounting Question Paper: 2019

👉Corporate Laws Question Paper: 2019

👉Environmental Studies Question Paper: 2019 2021

👉Business Maths and Statistics: 2019

👉General English Question Paper: 2019