If you're looking for the AHSEC Class 12 Accountancy question paper solution 2023, you're in Right place. We've compiled a detailed analysis of the exam paper, complete with explanations for all the questions.

If you're interested to read H.S 2nd Year Accountancy Question Paper Solution 2023, so follow the simple step read this article from top to bottom.

AHSEC Class 12 Accountancy Solved Question Paper 2023

2023

ACCOUNTANCY

Full Marks: 80

Pass Marks: 24

Time: Three hours

The figures in the margin indicate full marks for the questions

1. (a) Fill in the blanks with appropriate word/ words: (any four) 1x4=4

(i) Equity shareholders are owners of the company.

(ii) Receipts and Payments account is a summary of cash transactions.

(iii) Maximum number of members in a partnership business is 20.

(iv) In the absence of any agreement at the time of retirement of partner goodwill is to be adjusted in old profit-sharing ratio.

(v) Profit and Loss Account is also known as income statement..

(b) State whether the following statements are True or False: 1x2=2

(i) A company has a separate legal entity different from its members.

Ans:- True. A company has a separate legal entity different from its members. This is one of the fundamental characteristics of a company in terms of its legal structure.

(ii) Quick Assets = Current Assets – Inventory – Prepaid Expenses.

Ans:- True. Quick Assets are calculated by subtracting Inventory and Prepaid Expenses from Current Assets. So, the statement is true.

(c) Choose the correct alternative: 1x2=2

(i) The portion of the capital which can be called up only on the winding up of the company is called:

(a) Authorised capital

(b) Uncalled capital

(c) Reserve capital

(d) Issued capital

Ans:- (c) Reserve capital

(ii) Donation received for a specific purpose is a:

(a) Capital Receipt

(b) Revenue Receipt

(c) Asset

(d) Liability

Ans:- (b) Revenue Receipt

2. What is a Registered Debenture? 2

Ans:- Registered Debenture: It's a type of loan document where the company knows who the lender is, and they pay back the loan to that specific person or organization.

Or

What is ‘Data validation’?

Ans:-

3. What is Goodwill of a business? 2

Ans:- Goodwill of a Business: Goodwill is like a bonus value a business has because people like and trust it. It's the extra value a business has beyond just its stuff.

4. What is meant by Cash Flow from Operation Activities? 2

Ans:- Cash Flow from Operating Activities: This is the money a company makes or spends from its main business operations, like selling stuff or providing services. It shows if the business is doing well or not.

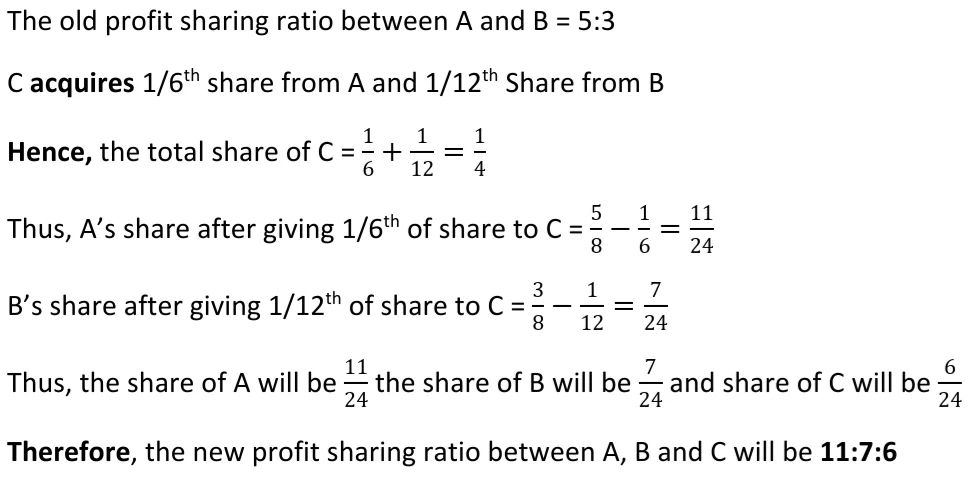

5. A and B are partners sharing profits and losses in the ratio of 5:3. C is admitted as a new partner for ½th share, which he acquires 1/6th from A and 1/12th from B. Calculate the new profit sharing ratio. 2

Ans:-

Or

Mention two rights of a partner. 2

Ans:- Two rights of a partner are:

Right to Participate in Management: Partners typically have the right to participate in the management and decision-making of the partnership unless otherwise specified in the partnership agreement.

Right to Share Profits: Partners have the right to a share of the profits earned by the partnership according to the agreed-upon profit-sharing ratio.

6. Write two limitations of ratio analysis. 2

Ans:- Two limitations of ratio analysis are:

Limited Information: Ratio analysis relies solely on financial data and may not consider external factors or qualitative aspects that can significantly impact a company's performance.

Historical Data: Ratios are based on historical financial information, and they may not always accurately predict future performance or account for sudden changes in a company's circumstances.

Or

Mention two limitations of financial statements. 2

Ans:- Two limitations of financial statements are:

1. Lack of Precision: Financial statements are prepared based on estimates, judgments, and accounting policies. This can result in a lack of precision and accuracy, making it difficult to reflect the true financial position of a company.

2. Historical Information: Financial statements provide information about the past performance and financial position of a company. They do not offer insights into future prospects or market conditions, limiting their usefulness for making forward-looking decisions.

Or

What is sequential code? 2

Ans:- Sequential code refers to a type of programming code where instructions are executed one after the other in a specific order, following a linear sequence. It's the typical way most computer programs are executed, with each statement being processed in the order it appears in the code.

7. What is the meaning of Cash Flow from Investing Activities? 2

Ans:- Cash Flow from Investing Activities represents the financial inflows and outflows related to a company's investments in assets such as property, equipment, and securities. It reflects the company's spending or receiving of cash for long-term investments.

Or

What is meant by the term ‘Cash Equivalents’? 2

Ans:- Cash Equivalents are highly liquid, short-term investments that are easily convertible into known amounts of cash with a short maturity period, typically within three months or less. They are considered as good as cash and often include items like Treasury bills and money market funds.

Or

Write a note on ‘Queries’. 2

Ans:-Queries in the context of databases refer to requests for information from a database. They are used to retrieve, update, or manipulate data stored in a database system.

8. Write any three essential features of partnership. 3

Ans:- Essential features of partnership:

a. Shared Profits and Losses: Partners share both the profits and losses of the business based on their agreed-upon share ratios.

b. Joint Ownership: Partners jointly own and manage the business, contributing capital, skills, or other resources.

c. Unlimited Liability: Partners are personally liable for the debts and obligations of the partnership, which means their personal assets can be used to settle business debts.

Or

Write three distinctions between ‘Profit and Loss Account’ and ‘Profit and Loss Appropriation Account’.

Ans:- The three distinctions between ‘Profit and Loss Account’ and ‘Profit and Loss Appropriation Account:-

9. Give any three differences between equity shares and preference shares. 3

Ans:- Three differences between equity shares and preference shares are:

Voting Rights: Equity shareholders typically have voting rights in the company, allowing them to participate in corporate decision-making, while preference shareholders generally do not have voting rights.

Dividend Priority: Preference shareholders have a preferential right to receive a fixed dividend before equity shareholders receive any dividends. Equity shareholders' dividends are based on profits available after paying preference dividends.

Redemption: Equity shares are typically not redeemable, meaning they don't have a fixed maturity date, whereas preference shares can be redeemable or have a fixed maturity date, allowing the company to buy them back from shareholders.

Or

Explain the following terms: 3

(i) Calls-in-arrears

Ans:- Calls-in-arrears refer to the amount of money that shareholders owe to a company for shares they have subscribed to but have not paid for in full. When a company issues shares, it typically does so in multiple installments or "calls." Shareholders are required to pay for the shares in these installments as specified by the company. If a shareholder fails to pay one or more of these installments, they are said to be "in arrears," meaning they have fallen behind on their payments. The company may take various actions, such as imposing penalties or forfeiting shares, to recover the amounts in arrears.

(ii) Calls-in-advance

Ans:- Calls-in-advance, on the other hand, refer to a situation where shareholders make payments for shares in advance of the company's specified payment schedule. In some cases, a company may allow shareholders to pay for shares in full or in part before the official call is made. This can happen when the company needs immediate funds for a specific purpose, and shareholders are willing to contribute in advance. Calls-in-advance are essentially prepayments for shares and are recorded as such in the company's accounts. These funds are held by the company until the official call is made, at which point the shareholders' advance payments are applied to their share subscription.

Or

Mention three differences between ‘Capital account’ and ‘Current account’. 3

Ans:- Ans:- The Three differences between 'Capital account' and 'Current account' are:

1. Nature of Transactions:

- Capital Account: The capital account primarily deals with long-term financial transactions, such as investments, loans, and capital contributions. It reflects changes in a country's ownership of foreign assets and liabilities.

- Current Account: The current account focuses on short-term and day-to-day transactions, including trade in goods and services, income earned and paid, and transfers. It reflects a country's current economic activity.

2. Components:

- Capital Account: Components of the capital account include foreign direct investment (FDI), foreign portfolio investment (FPI), loans and borrowings between countries, and changes in reserve assets.

- Current Account: Components of the current account include exports and imports of goods and services, income received from abroad (e.g., dividends and interest), and unilateral transfers (e.g., foreign aid and remittances).

3. Balance and Purpose:

- Capital Account: The capital account helps measure a country's net accumulation of foreign assets. A surplus in the capital account indicates that a country is receiving more capital inflow than outflow.

- Current Account: The current account measures a country's net income from international trade and its ability to meet its short-term international payment obligations. A surplus in the current account indicates that a country is exporting more than it imports.

Or

Describe three features of the Spreadsheet. 3

Ans:- Three features of a spreadsheet are:

1. Cells and Grid Structure:

- Spreadsheets are organized into a grid of rows and columns, where each intersection forms a cell. Cells can contain text, numbers, formulas, or functions, making it easy to arrange and manipulate data.

2. Formulas and Functions:

- Spreadsheets allow users to perform calculations and data analysis by using formulas and functions. Formulas use mathematical operators to perform operations on cell values, while functions are pre-built formulas for common tasks (e.g., SUM, AVERAGE, IF).

3. Data Visualization and Charts:

- Spreadsheets offer data visualization tools, allowing users to create various types of charts and graphs to present data visually. Charts can help users understand trends and patterns within the data.

These features make spreadsheets versatile tools for tasks such as data entry, analysis, budgeting, and financial modeling.

12. Prepare a Comparative Income Statement from the following particulars: 6

Or

What is meant by analysis of financial statements? Explain in brief the tools of financial statements? Explain in brief the tools of financial analysis. 1+5=6

Or

Give the limitations of computerised accounting system. 6

13. What is meant by issue of debentures as Collateral Security? Mention four differences between shares and debentures. 2+4=6

Or

Explain the objectives of Database Management System (DBMS)? 6

Or

Give Journal entries for issue and redemption of debentures under the following situations: 2x3=6

(a) 1,000 12% debentures of Rs. 100 each, issued at premium of 5% and redeemable at par.

(b) 2,000, 12% debentures of Rs. 100 each, issued at 5% discount and redeemable at a premium of 5%.

(c) 3,000, 12% debentures of Rs. 100 each, issued at par and redeemable at a premium of 5%.

14. A, B and C were in partnership sharing profits and losses equally. On 31st December, 2021 their Balance Sheet was as follows: 6

Balance Sheet

The firm took a joint life policy for Rs. 9,000 payable on the first death.

C died on 31st March, 2022. Under the partnership agreement the executors of a deceased partner were entitled to:

(i) Amount standing to the credit of deceased partner’s capital account.

(ii) His share of goodwill on the basis of twice the average of the past three years’ profits.

(iii) Share of profit from the closing of the last financial year to the date of death on the basis of last year’s profits.

(iv) Interest on capital @ 5% p.a.

(v) Profits for the last three years were:

2019 = Rs. 6,000

2020 = Rs. 8,000

2021 = Rs. 7,000

Prepare C’s capital account on the date of his death.

Or

Prepare Income and Expenditure Account from the following Receipts and Payments Account and other details of ‘Parizat’ club for the year ended 31st December, 2021: 6

Receipts and Payments Account

Other details:

(i) Total of Entrance Fee and Life Membership Fee are to be capitalised.

(ii) Depreciation on Sports Goods is Rs. 2,500.

(iii) Book value of the furniture sold was Rs. 1,500 on the date of sale.

Or

How would you compute the amount due to a retiring partner? 6

15. Sunu, Nanu and Nidhi are partners in a firm sharing profits in the ratio of 2:1:1. Their Balance Sheet as on 31st March, 2021 was as under: 6

Balance Sheet

The firm was dissolved on the above date. The assets realised as follows:

Furniture – Rs. 20,000

Land and Building – Rs. 1,00,000

Plant and Machinery – Rs. 50,000

Motor Car – Rs. 28,000

Debtors – 50% of Book Value

Realisation Expenses were Rs. 2,000

Prepare Realisation Account, Partner’s Capital Account and Cash Account to close the books of the firm.

Or

Write the situations when a partnership firm is dissolved by the court. 6

16. Amlan Company Limited issued 50,000 equity shares of Rs. 10 each at a premium of Rs. 2 each, payable as under:

On Application – Rs. 2

On Allotment – Rs. 5

On First and Final Call – Rs. 5

The shares were fully subscribed, called up and paid-up except allotment and call money on 500 shares. These shares were forfeited.

Give journal entries in the books of the company.

Or

Write short notes on: (any four) 2x4=8

(a) Securities Premium

(b) Over Subscription

(c) Re-issue of forfeited shares

(d) Unissued Capital

(e) Current asset

(f) Current asset

Or

Explain the steps involved in Computerised Accounting System in detail. 8

17. (a) Explain the average profit method of valuation of goodwill. 3

(b) What is revaluation account? 2

(c) How the adjustment of capitals is made at the time of admission of a new partner? 3

Or

Nitul and Atul are partners in a firm sharing profits in the ratio 2:1. Pranjal is admitted into the firm as a new partner with 1/4th share in profit. He will bring Rs. 30,000 as his capital. The Balance Sheet of Nitul and Atul as on 31.3.2020 was as under: 8

Balance Sheet

Other terms of the agreement are as under:

(i) Pranjal will bring in Rs. 12,000 as his share of goodwill.

(ii) Building was valued at Rs. 45,000 and Machinery at Rs. 23,000.

(iii) A reserve for bad debt is to be created at 6% on debtors.

Prepare Revaluation Account, Partner’s Capital Account and the Balance Sheet of the new firm.

18. Amit and Aditya are partners in a firm sharing profits and losses in the ratio of 3:1. The Trial Balance of the firm as on 31st December, 2022 was as under:

Trial Balance

Additional Information:

(i) Prepaid publicity Rs. 500

(ii) Commission received in advance Rs. 200

(iii) Provide for doubtful debts @ 5% on Sundry debtors.

(iv) Allow interest on partners’ capital @ 5% p.a.

From the above Trial Balance and additional information, prepare a Profit and Loss Account, a Profit and Loss Appropriation Account for the year ended 31st December, 2022 and a Balance Sheet as on that date.

-00000-

AHSEC Board Class 12 Accountancy Question Paper Solution 2023

Those students who are preparing for the Assam Board Class 12th exam must understand the exam pattern, marking scheme and other important information.

For this reason students must refer to AHSEC Class 12 Accountancy 2023 Question Paper Solution.

By referring to the Assam Board Class 12 Accountancy 2023 Question Paper Solution, students will get an opportunity to explore the various questions that were asked in the actual exam.In addition, they can use question papers to assess their preparation and work on gaps.

Assam Board Class 12 Accountancy 2023 Question Paper Solution Free PDF Download

Preparing for board exams is not just a crammed affair but it requires a lot of practice, being consistent and disciplined. Hence, we have provided the direct link of previous year question papers in PDF format here.

By reading these Assam Board Class 12 Accountancy - 2023 Question papers Solution students will be able to put effort in finding important questions and will be prepared for the annual board exam.Year-Wise Assam Board Class 12 Question Paper.

Every year, AHSEC evaluates 2nd year HS students by passing their board exams. With his help, the committee decides which students will be considered to have passed or failed in the academic year.

The difficulty level of the questions varies every year and that is why we have provided the Assam Board Class 12 All Year Question Paper PDF here.

Benefits of using AHSEC Assam HS 2nd Year Accountancy 2023 Question Paper Solution

Assam Board Class 12th students who are keen to excel should definitely know the benefits of using AHSEC Assam HS 2nd Year Question Papers Solution Accountancy 2023

Benefits are:-

- AHSEC 12th Class Accountancy 2023 Previous Year Question Paper Solution makes a difference in preparing students for exams. Rather than covering many topics, past year papers allow students to find the right topics to focus on.

- Students who invest their time in answering previous year question papers can feel how difficult or easy their Assam Board Class 12 exam would be.

- By solving Assam Board Class 12 Accountancy - 2023 Question Paper, Assam Board Class 12th candidates can experience the real exam, build their confidence and get the satisfaction of how well they can perform.

- It also helps to know the time required to solve all the questions asked in Assam 12th Board Exam.

- Solving old questions also lets the candidates know how best they can give in the actual board exam.

Conclusion

Disclaimer : Please note that the Question Paper solutions provided on The Treasure Notes website are for educational purposes only. We make no warranty or representation about the completeness, accuracy, reliability, suitability, or availability of the solutions on our website. Therefore, any reliance you place on the solutions is strictly at your own risk. We encourage our users to verify the solutions with their own methods and resources. Please use the solutions provided on our website at your own risk.